The Math Income Tax Brackets Answer Key provides a comprehensive guide to understanding the complexities of income tax brackets and their impact on your financial well-being. This essential resource offers a clear and concise explanation of the different income tax brackets, the corresponding tax rates, and the implications for individuals’ tax liability.

Delving into the intricacies of tax calculations, the answer key meticulously Artikels the steps involved in determining your tax liability. It provides illustrative examples for various income levels, highlighting the role of deductions and credits in reducing your tax burden.

Additionally, the answer key addresses the requirements for filing income taxes, ensuring that you meet your obligations and avoid potential penalties.

Income Tax Brackets

Income tax brackets are a series of income ranges that determine the tax rate applied to an individual’s taxable income. Each bracket has a specific tax rate, and as an individual’s income increases, they may move into higher tax brackets with higher tax rates.

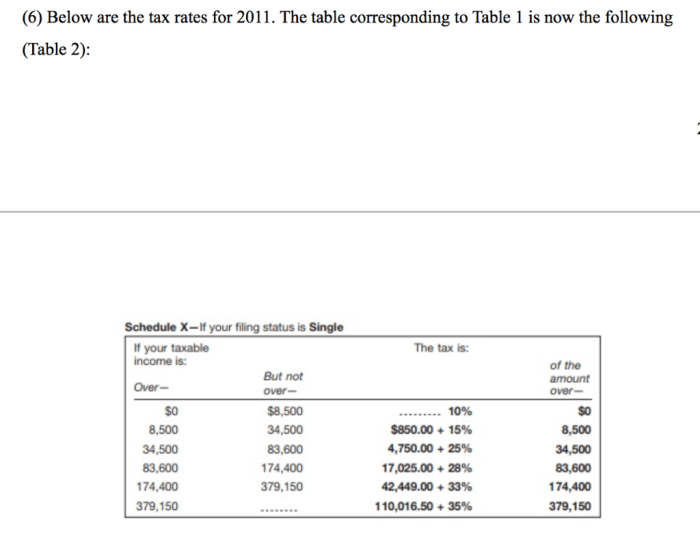

The following table shows the income tax brackets for individuals in the United States for 2023:

| Filing Status | Taxable Income Range | Tax Rate |

|---|---|---|

| Single | $0

|

10% |

| Single | $10,276

|

12% |

| Single | $41,776

|

22% |

| Single | $89,076

|

24% |

| Single | $170,051

|

32% |

| Single | $215,951

|

35% |

| Single | $539,901

|

37% |

| Single | $1,077,351+ | 39.6% |

The impact of tax brackets on an individual’s tax liability is significant. As an individual’s income increases, they may move into higher tax brackets, resulting in a higher percentage of their income being taxed at a higher rate.

This can lead to a significant increase in the total amount of taxes owed.

Tax Calculations: Math Income Tax Brackets Answer Key

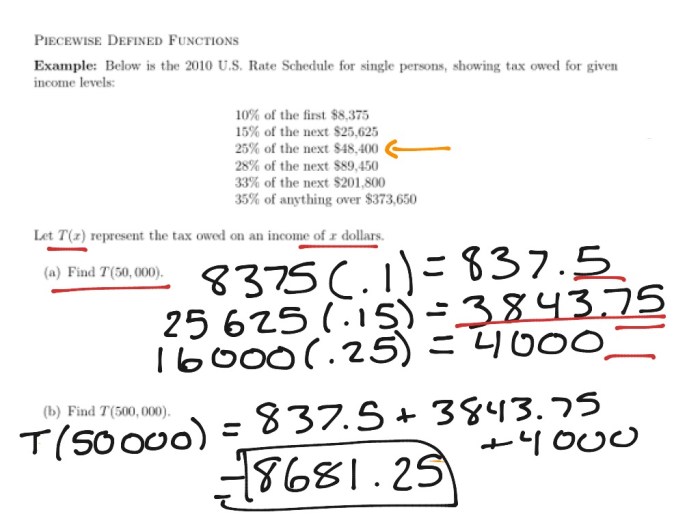

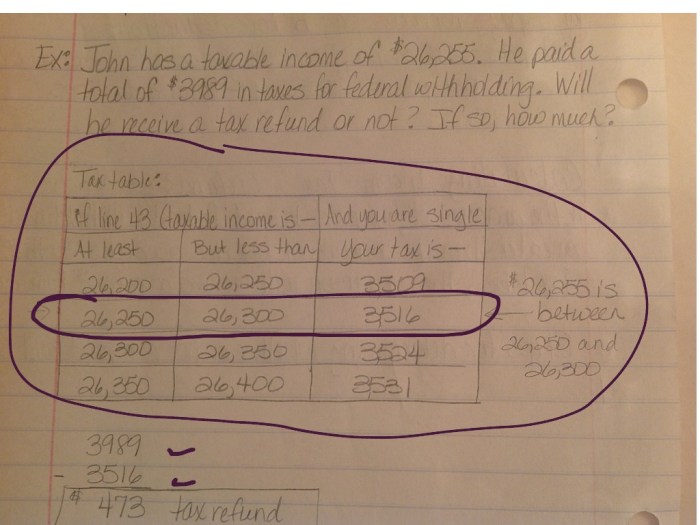

Calculating income tax involves several steps:

- Determine your taxable income. This is your total income minus eligible deductions and exemptions.

- Identify the tax bracket you fall into based on your taxable income.

- Calculate the amount of tax you owe for each tax bracket. This involves multiplying the taxable income within each bracket by the corresponding tax rate.

- Add up the tax amounts for each bracket to determine your total tax liability.

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. Common deductions include mortgage interest, charitable contributions, and retirement contributions. Common credits include the earned income tax credit and the child tax credit.

Filing Requirements

Individuals are required to file income taxes if their income meets certain thresholds. The filing requirements vary depending on filing status and age.

For 2023, the general filing requirements for individuals are as follows:

- Single: $12,950

- Married filing jointly: $25,900

- Married filing separately: $12,950

- Head of household: $20,800

The deadline for filing income taxes is April 15th of each year. If you cannot file by April 15th, you can request an extension to file until October 15th.

Failure to file taxes on time can result in penalties and interest charges.

FAQ Summary

What is the purpose of the Math Income Tax Brackets Answer Key?

The Math Income Tax Brackets Answer Key provides a comprehensive guide to understanding income tax brackets, calculations, and filing requirements, empowering individuals to make informed decisions and optimize their tax strategies.

How does the answer key help me understand tax calculations?

The answer key provides step-by-step instructions for calculating income tax, including illustrative examples for various income levels. It also explains the role of deductions and credits in reducing tax liability.

What are the filing requirements for income taxes?

The answer key Artikels the requirements for filing income taxes, including who is required to file, the deadlines for filing, and the consequences of not filing on time.